As summer swings into its second half, another season starts to make its presence felt: hurricane season. And with hurricane season comes the need for hurricane travel insurance.

Hurricane season is the time of the year, officially June through November, when Atlantic and Caribbean waters warm and conditions become right for the development of large, severe storms. These storms can be trip-wreckers for popular vacation destinations that are often in the path of hurricanes, including the Caribbean, Hawaii, Mexico, Florida, and the Carolinas.

How can you help protect your vacation from being ruined by a hurricane? One way is to get travel insurance before a storm is named. Plans from Generali Global Assistance provide coverage for a variety of weather-related events.

Hurricane Season Impact on Travel

Because factors like the overall ocean temperature and weather patterns differ from year to year, hurricane seasons vary in their severity. But, even an average season can result in a handful of major hurricanes that could wreck a trip.

According to the National Oceanic and Atmospheric Administration, there’s “a 70% probability for each of the following ranges of activity” during an average season:

- 9-15 named storms

- 4-8 hurricanes

- 2-4 major hurricanes

NOAA expects most of the storm activity to take place between August and October. If during that time you’re planning a trip to a hurricane zone – especially the Caribbean – seriously consider buying travel insurance for coverage against certain weather-related travel issues.

Also read: Find the Best Caribbean Islands for Every Month of the Year

Does travel insurance cover weather events like hurricanes?

Yes – but we have to be careful how we define “cover.”

If the lodging at your destination is destroyed by a hurricane and you have to cancel your trip, the answer is yes. If you’re at your destination, a hurricane strikes, and the government says you have to evacuate, you can be covered with a Generali plan.

If you’re injured in a hurricane while traveling, your medical expenses can be covered. If your injuries are severe enough that you have to be evacuated, that can also be covered, up to the coverage limits.

With Generali, you even have coverage if your own home is made uninhabitable by a hurricane and you have to cancel or interrupt your trip.

Not all travel insurance companies or plans cover storm-related cancellations and interruptions the same way, so read Plan Documents carefully before you buy – especially if you’re headed to the Caribbean during hurricane season.

Does travel insurance cover hurricane-related delays?

That’s an interesting question, and like a lot of interesting questions that have to do with travel insurance, the answer is: “it depends.”

In the case of travel delay, it depends on:

- The plan you bought;

- Whether you’re delayed long enough; and

- What you did during the delay.

All Generali plans have some travel delay coverage; however, they differ in the amount per day you can claim and the length of time you have to be delayed for the coverage to kick in.

Travel delay coverage reimburses you for expenses you incurred while you were delayed – food and lodging, mainly, not that Gucci bag you saw in the gift shop while killing time. It also doesn’t cover you if your flight was delayed an hour and all you did was sit in the airport lounge playing Candy Crush.

Okay, but what about getting caught up with your cruise or tour, if they’re out of the hurricane zone but there’s a Category 5 storm wreaking havoc with your travel plans?

That could fall under Trip Interruption or Missed Connection coverage, and Generali offers that as well – and we can help make the arrangements to get you caught up. So travel insurance has a lot of ways to deal with weather delays.

When to buy trip insurance for a storm

If you buy travel insurance after a storm is named, your plan will not provide coverage for storm-related claims. See our Storm Coverage Alerts for more information.

We suggest you buy a travel insurance plan when you make your first trip payment, like airfare or a cruise. That way you have a long coverage period in case you need to cancel your trip, and if you need to file a claim related to a storm, you will have bought the plan well before the storm was forecasted.

Generali travel insurance plans can be purchased up to 18 months before the trip departure date and up until the day prior to departure.

Is hurricane travel insurance worth it?

There are many ways you can try to help protect your vacation from hurricanes – even a Caribbean vacation. You can stay on islands in the southern Caribbean, like Aruba and Curacao. You can avoid the Caribbean or hurricane zones entirely during hurricane season. You can follow the tips in our article on prepping for travel during hurricane season.

However, even if you do all those, travel insurance is a good idea if you’re taking a vacation during hurricane season. Like every other part of travel, weather is unpredictable. When it’s hurricane season, you just never know. So why put your vacation investment at risk?

Storm Travel Insurance FAQs

If you buy travel insurance after a storm is named, your plan will not provide coverage for storm-related claims. See our Storm Coverage Alerts for more information.

We suggest you buy a travel insurance plan when you make your first trip payment, like airfare or a cruise. That way you have a long coverage period in case you need to cancel your trip, and if you need to file a claim related to a storm, you will have bought the plan well before the storm was forecasted.

Generali travel insurance plans can be purchased up to 18 months before the trip departure date and up until the day prior to departure.

If you are evacuated during your trip due to adverse weather or a natural disaster, we encourage you to seek accommodations out of harm’s way—with the hope that you can return to your trip when the evacuation ends. Generali Global Assistance reimburses for certain out-of-pocket costs during the evacuation, such as hotel stays, meals and local transportation. The delay will have to be for the specified amount of time listed in your Plan Documents.

The plans include coverage for insured trip costs you can’t use when a mandatory evacuation is in effect as long as the loss for your trip occurs within the first 30* calendar days after the mandatory evacuation order is issued. You can qualify for reimbursement for the remaining portion of your trip if you have 50%* or less—or 4* days or less—of your reservation left when the evacuation order is lifted at your destination.

*Day and percentage requirements may vary by state. Review your Plan Documents for full details.

If your destination is evacuated due to adverse weather or a natural disaster, such as a hurricane, you can be reimbursed for your insured trip costs. The plans can only provide coverage for losses that occur for your trip within the first 30* calendar days after the initial mandatory evacuation order was issued. You qualify for a full cancellation if you have 50%* or less—or 4* days or less—of your trip remaining when the evacuation order is lifted, at your destination.

Plans include similar coverage if the accommodation at your destination is deemed uninhabitable.

You can also be covered if your flight is canceled or delayed because of adverse weather.

*Day and percentage requirements may vary by state. Review your Plan Documents for full details.

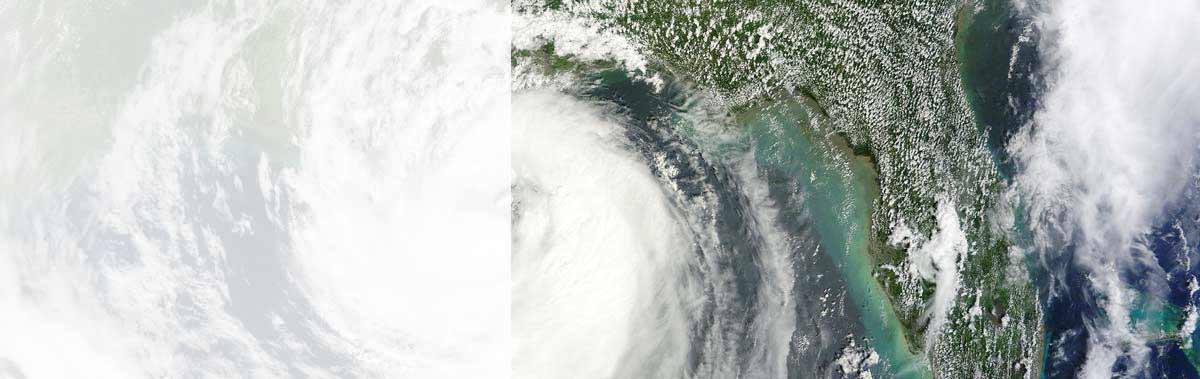

* Image source: "Hurricane Isaac Near Landfall" by NASA Goddard MODIS Rapid Response Team, used under CC BY 2.0 / Cropped from original

† If you buy travel insurance after a storm is named, your plan will not provide coverage for storm-related claims. See Storm Coverage Alerts

Map Data Source: Colorado State University's Tropical Cyclone Impact Probabilities report

A7731907, A112862205